Trusted by Europe’s leading retailers and financial institutions

“Oneytrust helped us secure our digital onboarding process from day one—ensuring only reliable, verified users were approved. D-Risk ID is now core to our fraud defense strategy.”

Stéphane Richard, CEO of GreenLeaze

French subscription-based buying platform

Why identity verification is no longer optional

Digital onboarding opens the door to high-volume fraud. Fraudsters now create identities, not just steal them. They mix real and fake data to build synthetic profiles that pass basic KYC.

Without reliable verification, businesses risk onboarding fraud rings, facing chargebacks, account abuse, and reputational damage.

Key identity threats:

- Synthetic profiles built with real & fake data

- Impersonation using stolen credentials

- Repeat abuse using throwaway identities

- High-friction checks driving away real users

Real-time digital identity verification—without slowing users down

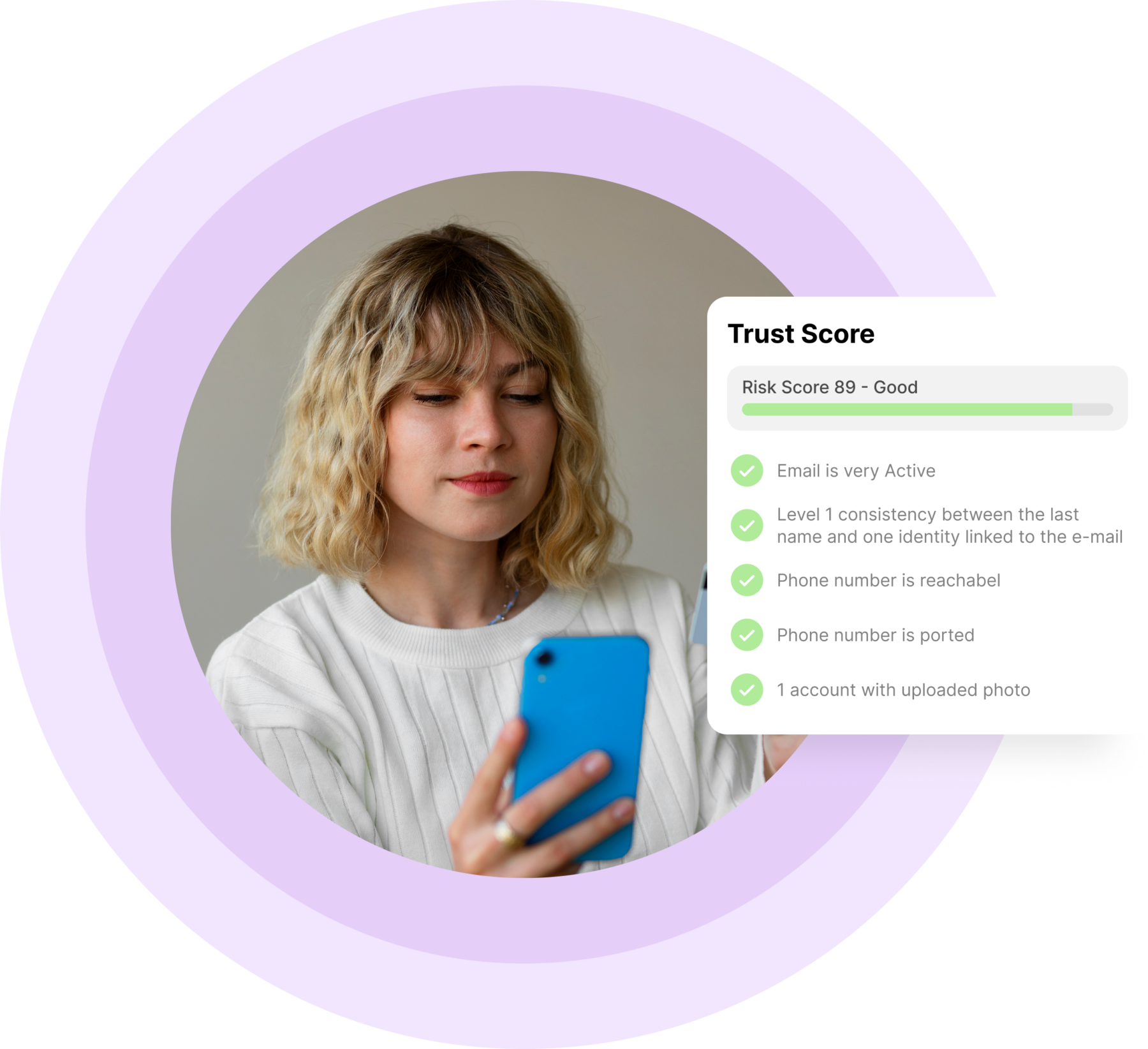

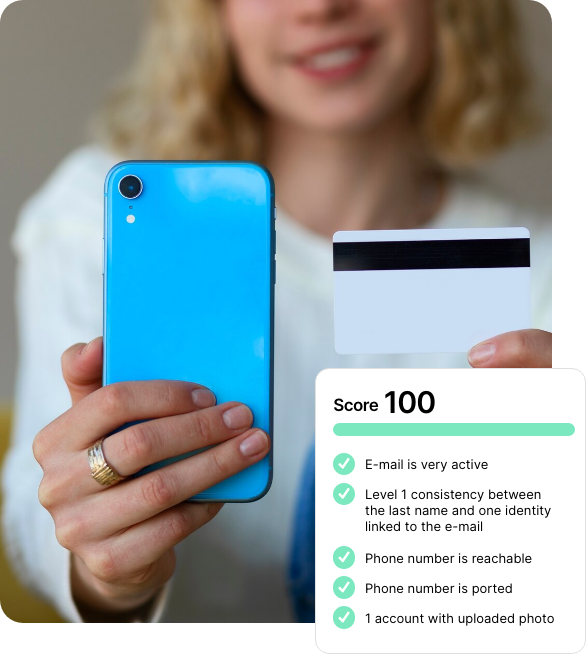

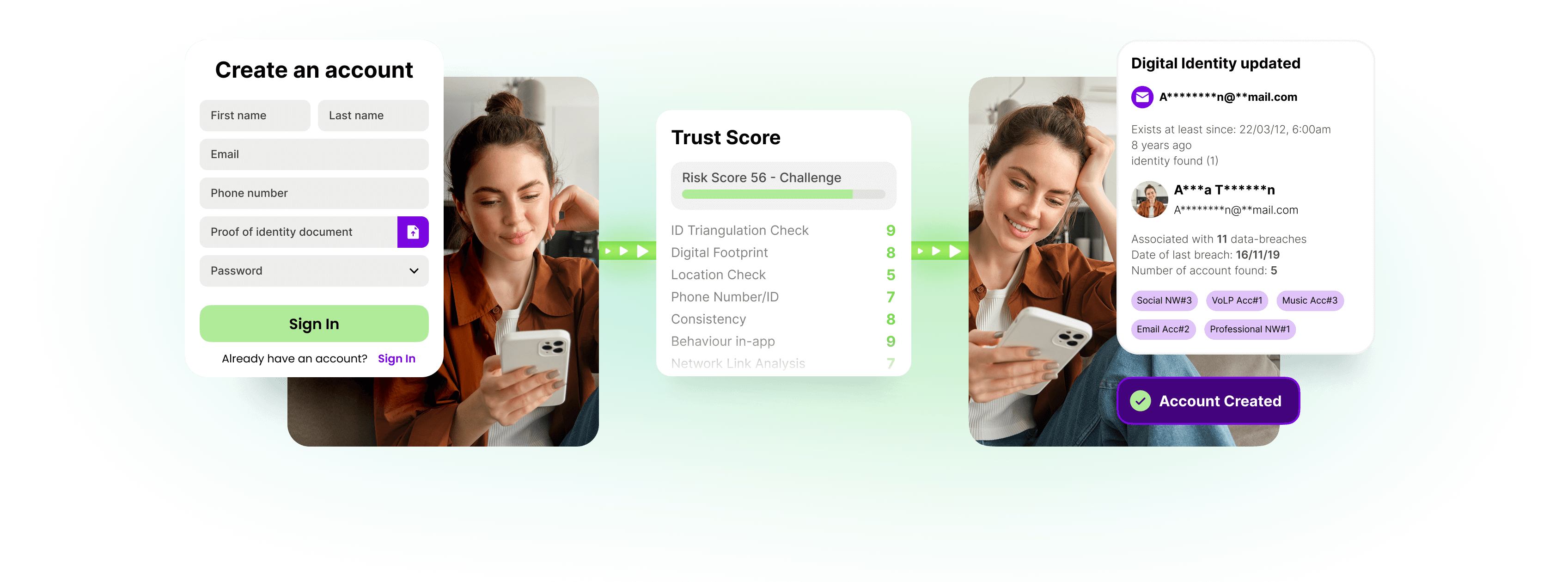

D-Risk ID combines multiple layers of analysis to calculate a real-time identity trust score—so you can approve good users instantly and stop bad ones at the door.

- Identity signal analysis: Names, emails, phones, and addresses cross-checked with third-party and consortium data

- Synthetic identity detection: Flags identities with no digital footprint or mismatched data

- Device & network fingerprinting: Correlates devices, IPs, and behaviors across our trusted identity graph

- Behavioral analysis: Detects bots, industrial-scale fraud attempts, and repeated abuse

- D-Risk ID trust score: Real-time score adjusts to your risk tolerance and business model

- <2 second decisions: Fast scoring ensures seamless experiences for legitimate users

Key Result:

Built on over 15 million verified real identities, and millions of device and identity elements, D-Risk ID flags synthetic profiles and impersonators with precision—while keeping approval rates high.

FAQs – Digital Identity Verification

See how D-Risk ID helps you approve trusted users. Fast.

Stop identity fraud before it starts without compromising customer experience.

Book a live demo or get in touch to see how D-Risk ID can strengthen your onboarding.