Identity-Centered Fraud Detection

D-Risk Commerce by Oneytrust secures every stage of the customer journey.

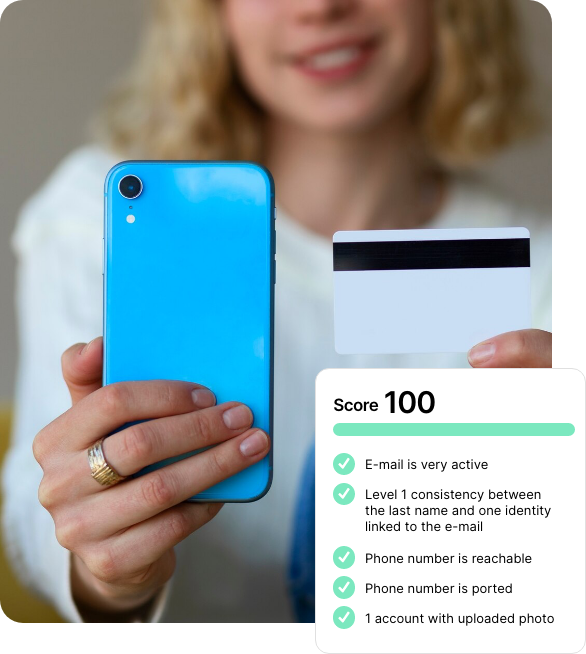

From registration to payment and even post-payment processes like returns and refunds, D-Risk Commerce scores every customer interaction. By leveraging identity data, our fraud scores ensure more accurate decisions and higher conversions for our clients.

Accept new genuine customers, enable seamless payments, and provide frictionless buying experiences—all while keeping bad actors off your platform.

That’s why we say: Only Trusted Customers.

.

Trusted by Europe’s leading retailers and financial institutions

D-Risk Commerce Key Benefits

customers

commerce

chargebacks

identities

conversion rates

99%+ Acceptance rate

Secure Onboarding

D-Risk Commerce combines third-party and proprietary data to deliver highly accurate identity scores at registration. Our algorithms validate connections between data points to confirm a legitimate identity. For added assurance, we cross-check against the only CNIL-approved consortia database in fraud detection.

This is what we mean by identity-first fraud detection.

Secure Transactions

D-Risk Commerce expands its identity score with a complete fraud suite powered by machine learning, graph analysis, and a robust rules engine. Risky transactions are flagged for merchants, enabling automated decisions to block or challenge based on your risk tolerance. Combining identity and transaction data ensures higher conversion rates with minimal false positives.

Trade with confidence.

Frictionless Commerce Built In

D-Risk Commerce is 3DS-native, seamlessly aligning with your authentication preferences. For low-risk transactions, we request exemptions, while higher-risk transactions are flagged for liability shifts to banks. While bank responses aren’t guaranteed, we maximize your chances of providing a smooth buying experience for trusted customers

Meet your new fraud team

At Oneytrust we have been fighting fraud for Europe’s largest eCommerce businesses for 24 years. Our crack team of “DarkSpies” trawl the dark web for new or specific threats to our clients. Our account team works with clients to really understand the threatspace. All of our data is stored in Europe. Together with our merchants and finance partners we make an unbeatable team.

Let’s face fraud together

Retail’s newest fraud risk

Tackle Returns Abuse

D-Risk Commerce analyzes identity data and transaction history to create a returns fraud score, helping merchants address the fastest-growing fraud problem in e-commerce.

Our 4-Step Approach:

- Analyze returns abuse on a case-by-case basis

- Conduct data and network analysis of customers

- Build a Returns and Refunds Fraud Score

- Set a customized risk threshold

GDPR:

Compliant by design

At Oneytrust we build our products to be GDPR compliant from the ground up and ensure fully compliant processes: