“Oneytrust enabled us to identify €160,000 in return fraud within three months in 2024—without slowing down our sales. Their synthetic identity detection allowed us to safely expand BNPL to more product ranges.”

Rachid Rhilan

Head of Fraud & Payments, Galeries Lafayette

Top challenges in luxury

e-commerce

Luxury e-commerce retailers face unique and constantly evolving threats that require expertise, experience, and cutting-edge technology. The mix of highly resellable high-value products and costly errors in customer decisions makes robust fraud defense essential. These threats evolve continuously as fraudsters adapt to bypass SCA and PSD2 requirements.

- Return and refund fraud

- Synthetic identity & BNPL exploitation

- International card fraud

How Oneytrust fights fraud in the luxury sector

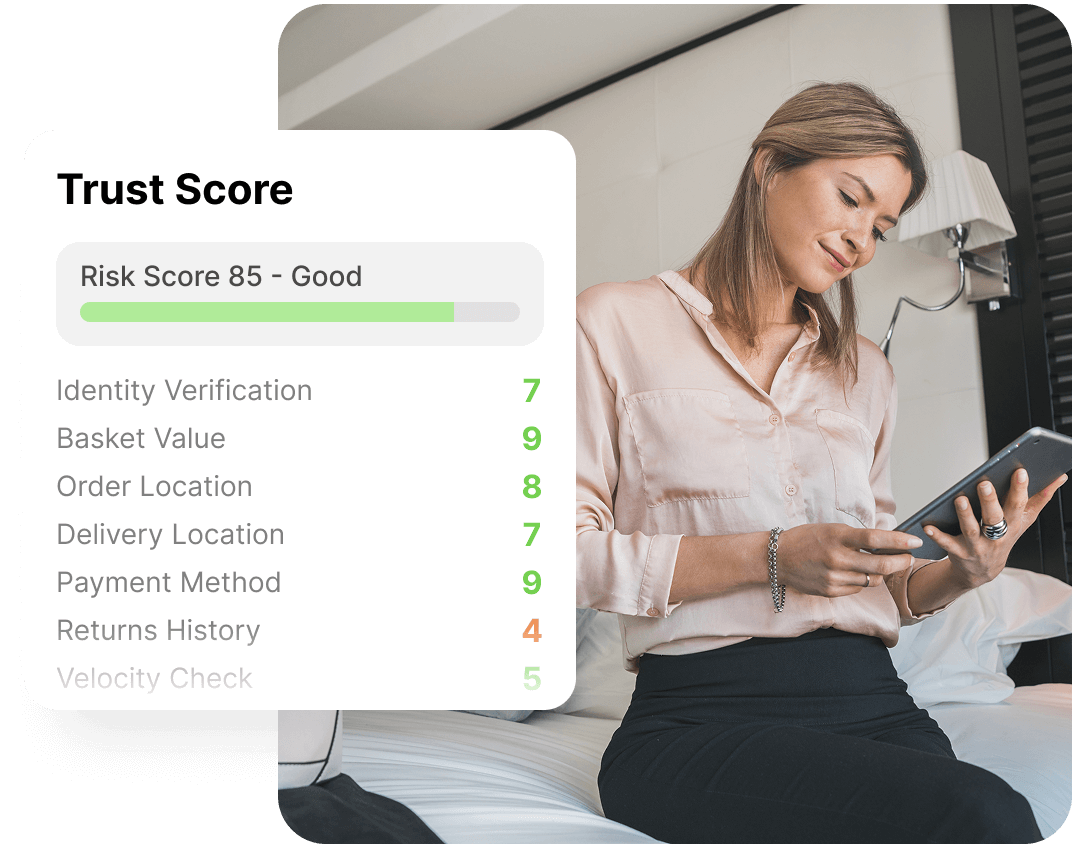

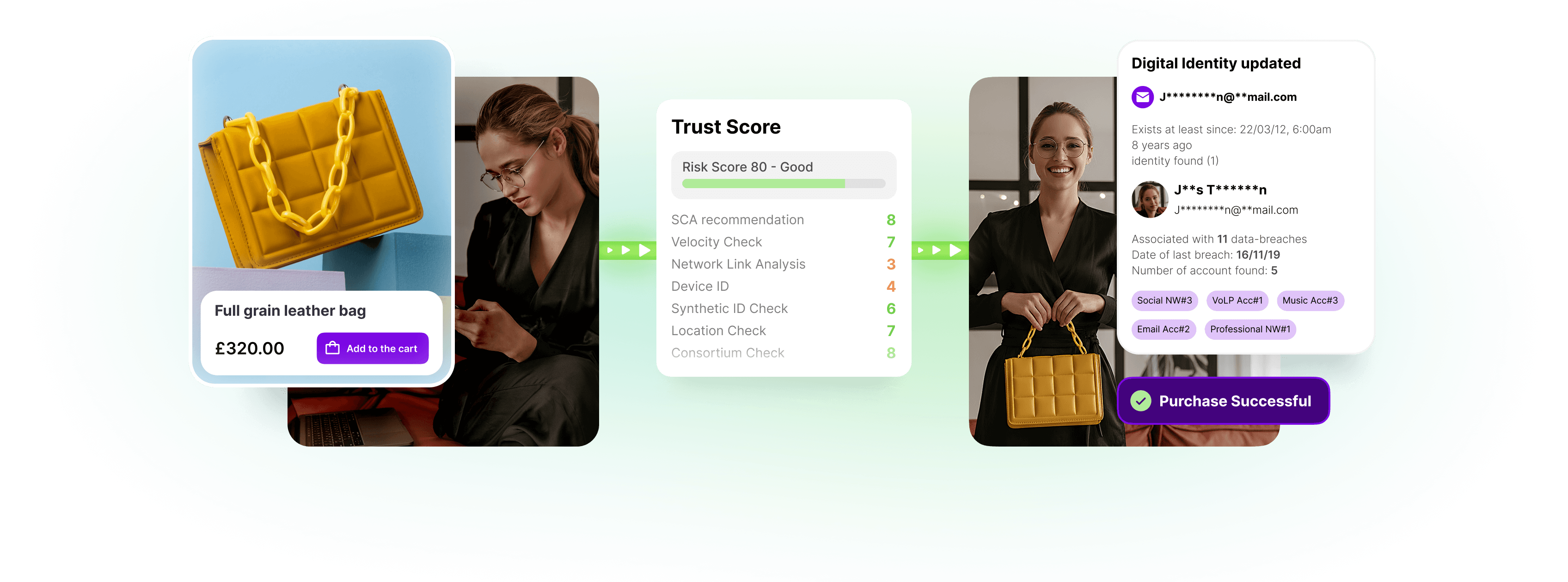

Oneytrust delivers pinpoint detection where precision matters most. Our machine learning models, trained on millions of luxury transactions, evaluate each order in under 2 seconds. With millions of verified identities, we detect fake profiles. Adaptive risk signals spot anomalies in high-value orders—while preserving a smooth experience for trusted customers.

- Real-time scoring optimized for high-value, international orders

- Graphical analysis: detection of connections and structures characteristic of suspicious patterns.

- Device fingerprinting and proprietary data consortium to detect coordinated fraud

FAQ – Key questions in luxury fraud

See Oneytrust in action for luxury retail

Discover how leading luxury brands reduce refund abuse and CNP losses by up to 70% with Oneytrust’s identity-based protection.