What our clients say…

“Identity fraud now accounts for over 60% of fraud in remote account opening. Oneytrust’s D-Risk ID allowed us to verify users in real time and reduce onboarding risk—without slowing down legitimate customers.”

Head of Anti-Fraud Strategy

European Retail Bank (anonymous)

Why Identity Risk is critical in banking

Digital onboarding has opened new doors for fraud. Both traditional and challenger banks are seeing an increase in identity fraud—driven by synthetic profiles and forged documents that bypass traditional KYC and AML checks.

Top Threats:

- Creation of synthetic identities

- Opening of mule accounts

- New account fraud

- Increasing regulatory pressure (AML, PSD2)

How Oneytrust protects banking onboarding from day one

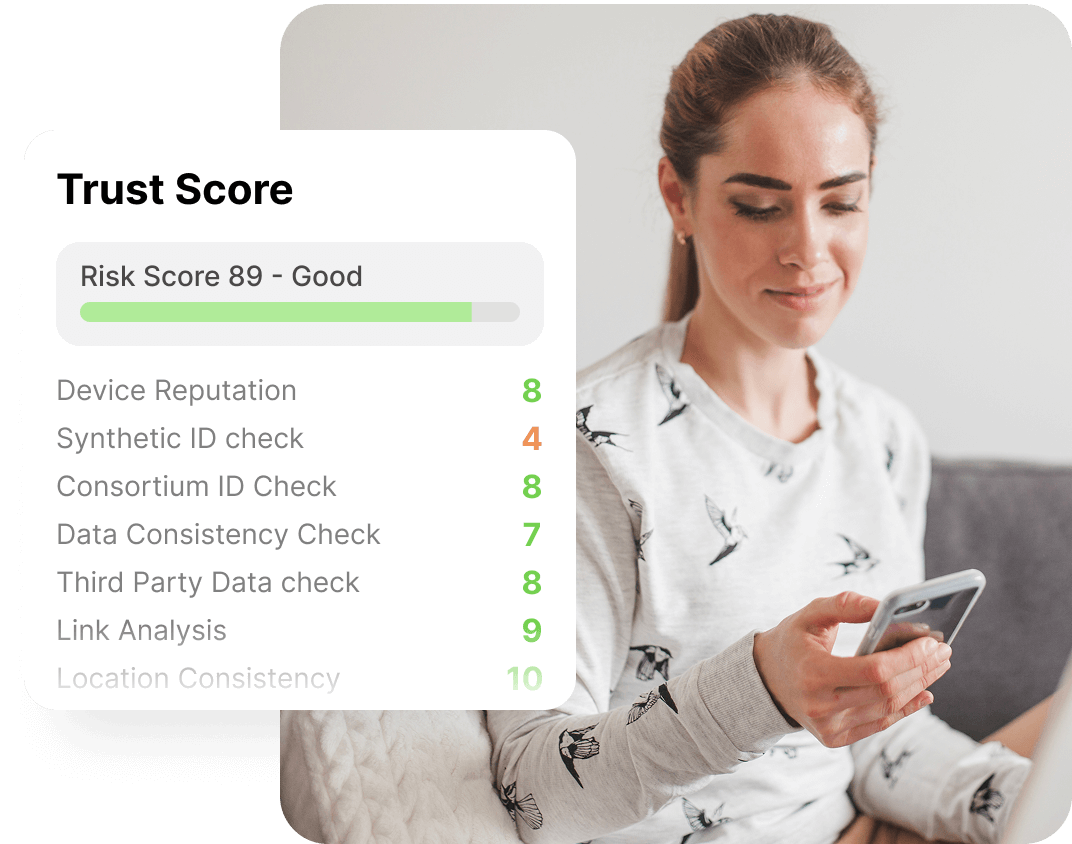

Oneytrust’s D-Risk ID procuct takes an identity-first approach to secure customer onboarding. Through behavioral analysis and digital signals, we detect falsified, modified, or synthetic identities in under 2 seconds—so banks can focus on growing securely.

Key Features:

- Synthetic identity detection

- Identity risk scoring in under 2 seconds

- Behavioural analysis and device fingerprinting

- Fast API integration

Identity Verification in banking. What you need to know

See how Oneytrust stops identity fraud for banks

Talk to our experts about how we can prevent identity fraud, improve KYC and help protect your banks from synthetic identity abuse.