“Thanks to Oneytrust, we secured our subscription model from day one, guaranteeing reliable, creditworthy customers for our partners. This collaboration lets us focus confidently on our growth.”

Stéphane RICHARD,

CEO of GreenLeaze

The evolving face of Identity Fraud

Fraudsters no longer need to steal identities — they create them. Synthetic identities now account for a major share of losses in digital banking, fintech, BNPL, and e-commerce. Add in impersonation, bots, and mule accounts, and verifying identity is more complex than ever.

Synthetic Identities

Fake profiles passing basic KYC

Impersonation

Real info misused by fraudsters

Frictionless Abuse

Reduced checks increases risk in onboarding

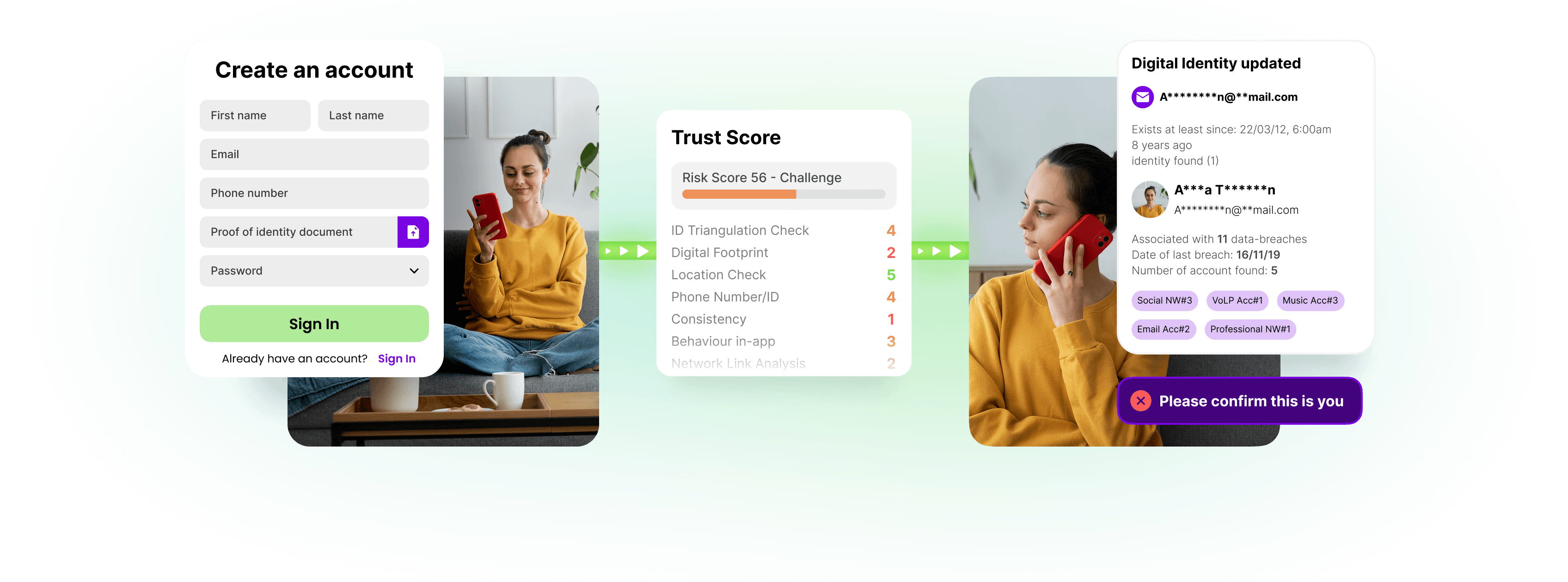

Our multi-layered approach to Identity Verification

Oneytrust doesn’t just score risk — we validate digital identity from every angle.

Identity Element Analysis

• Cross-check name, phone, email, address with third-party data

• Flag anomalies and unique combinations

Synthetic Identity Detection

• Identify profiles with no digital footprint

• Spot inconsistent or fabricated identity sets

Device Fingerprinting & Network Signals

• Match users to device, IP, and browser metadata

• Share suspicious behaviors across the Oneytrust client network

Behavioral Analysis

• Spot bots and industrial-scale fraud attempts

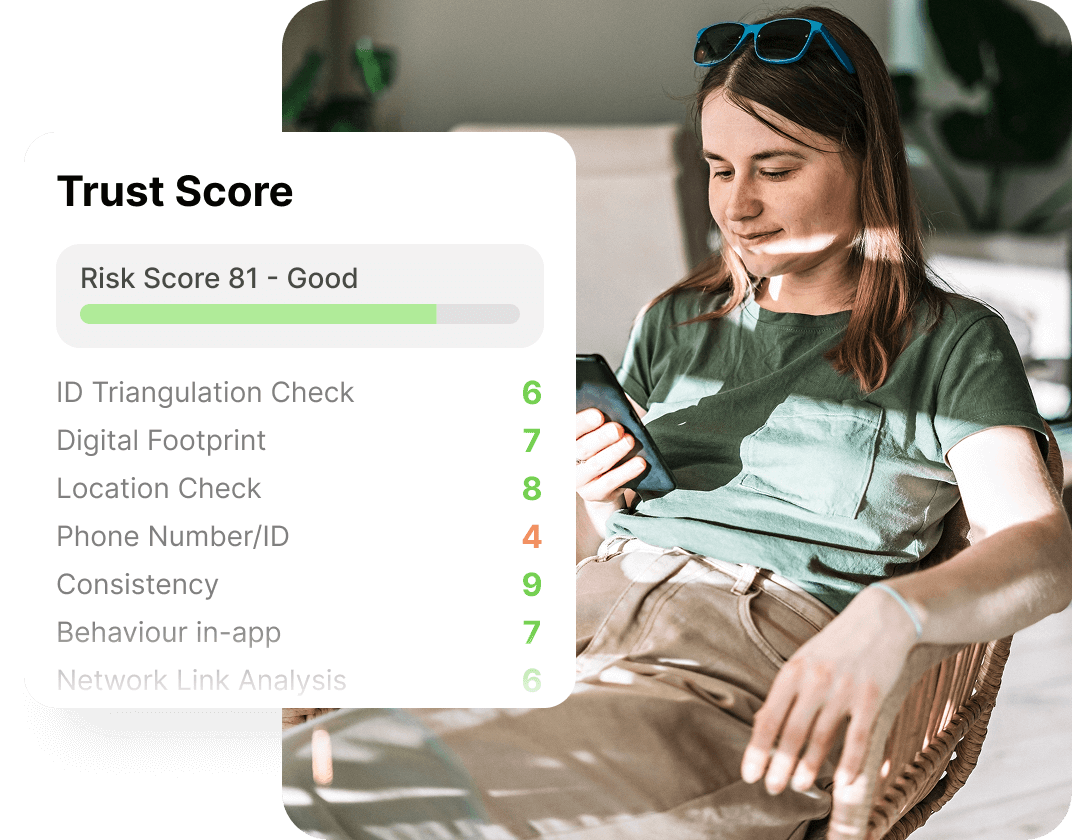

D-Risk ID Trust Score

• Real-time identity reliability index

• Adjustable thresholds by industry or use case

FAQ’s – What fraud professionals want to know

See how Oneytrust can help you onboard with confidence

See how our identity solution reduces fraud, ensures compliance, and keeps good customers signing up for your service.