“Thanks to Oneytrust, we were able to secure our subscription model from day one, guaranteeing our partners reliable and creditworthy customers. This partnership lets us focus on growing with complete peace of mind.”

CEO of GreenLeaze

French subscription-based buying platform

Main challenges in leasing and credit

Fraudsters exploit the simplicity of online onboarding to create fake profiles or use stolen credentials to access high-value products through credit or leasing. Combined with payment defaults and “bust-out” fraud, risks can escalate quickly.

- Rise of synthetic identities: Fraudsters blend real and fake data to bypass KYC checks.

- Bust-out risk: A customer with a good history commits major fraud after gaining merchant trust.

- Manual verification overload: Too many low-value files clog operations and reduce conversion rates.

How Oneytrust protects leasing and credit providers

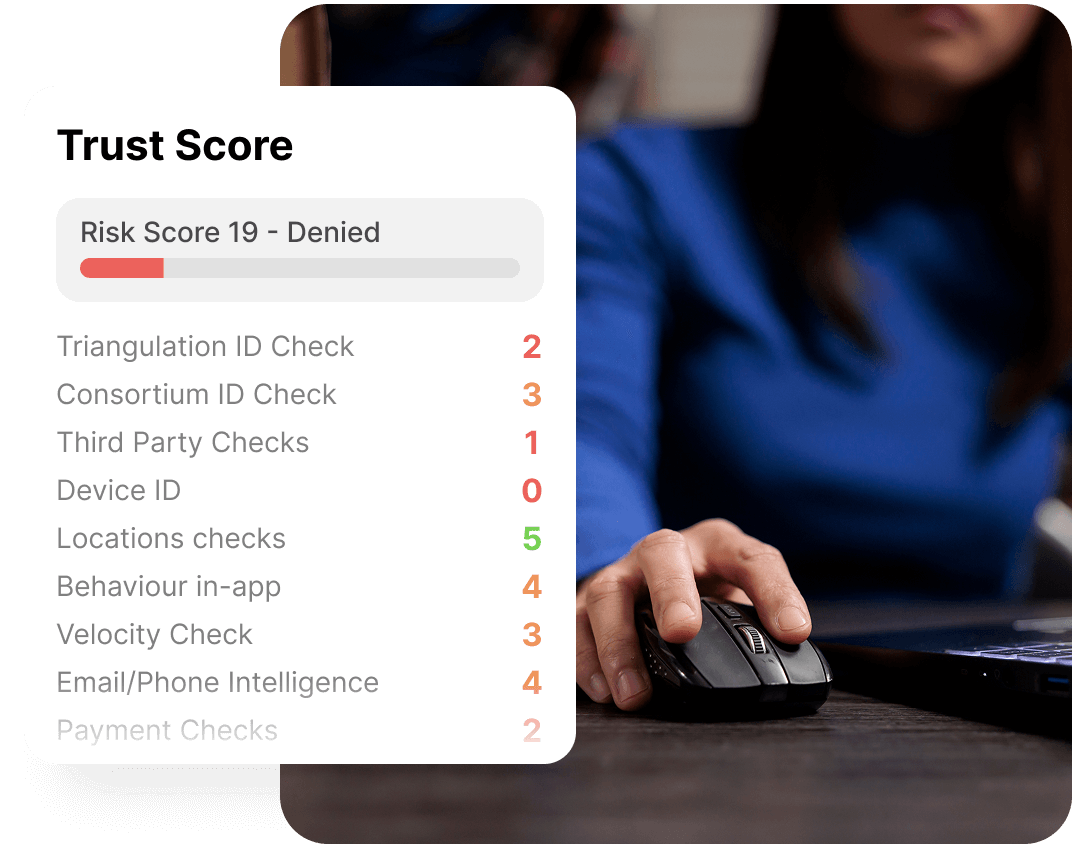

Oneytrust’s D-Risk ID uses a multi-layer identity scoring model to detect fraudsters and assess applicant quality—before any credit is granted.

- Synthetic identity detection: Machine learning identifies falsified digital histories and inconsistencies in identity data.

- Real-time trust scoring: D-Risk ID evaluates each applicant based on network data, behavior, and device fingerprint.

- Device fingerprinting and behavioral data: Spot repeated attempts and “mule” activities across multiple accounts.

Leasing and Credit fraud: key questions answered

See how we help you approve trustworthy clients faster

Reduce synthetic ID fraud, limit payment defaults, and streamline customer onboarding with Oneytrust’s digital identity verification for credit and leasing providers.