“With Oneytrust, we were able to fight the fraud networks targeting our business while continuing to expand internationally. Thanks to the quality of its pre-scoring recommendations, Oneytrust helped us improve our frictionless rate with our customers. We truly value the team’s support and our partnership.”

FRÉDÉRIC MARECAILLE

Head of Payment and Fraud at Vertbaudet

What makes fraud in large-scale e-commerce so persistent?

Retailers face relentless fraud attempts across multiple channels and categories. Fast-moving inventory, complex return processes, and diverse payment methods give fraudsters more avenues for exploitation — and their tactics evolve quickly.

Main threats:

- Refund and return abuse: Increasing automation allows fraudsters to easily exploit generous return policies at scale.

- Synthetic identity and BNPL (Buy Now, Pay Later) fraud: Fraudsters use synthetic profiles to take advantage of new payment options, often bypassing traditional systems.

- Cross-border and CNP (Card-Not-Present) fraud: International expansion brings risks from unfamiliar payment environments and fraud networks operating across borders..

How does Oneytrust stop e-commerce fraud in real time?

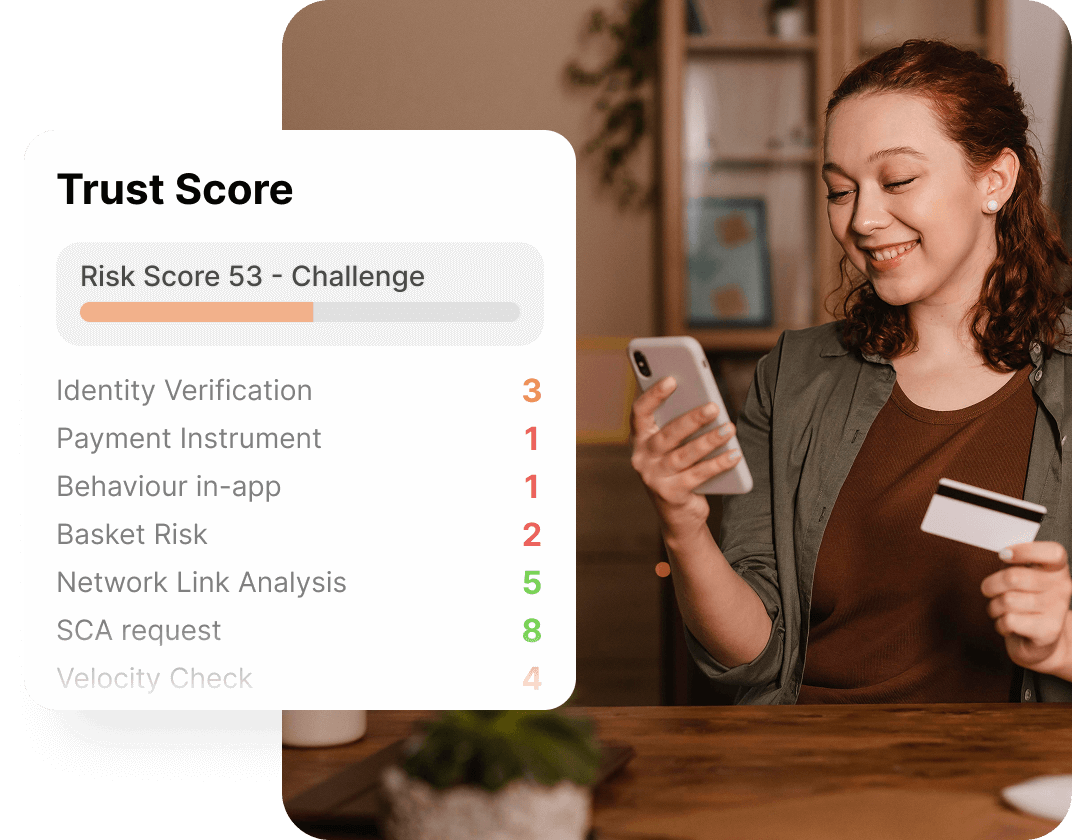

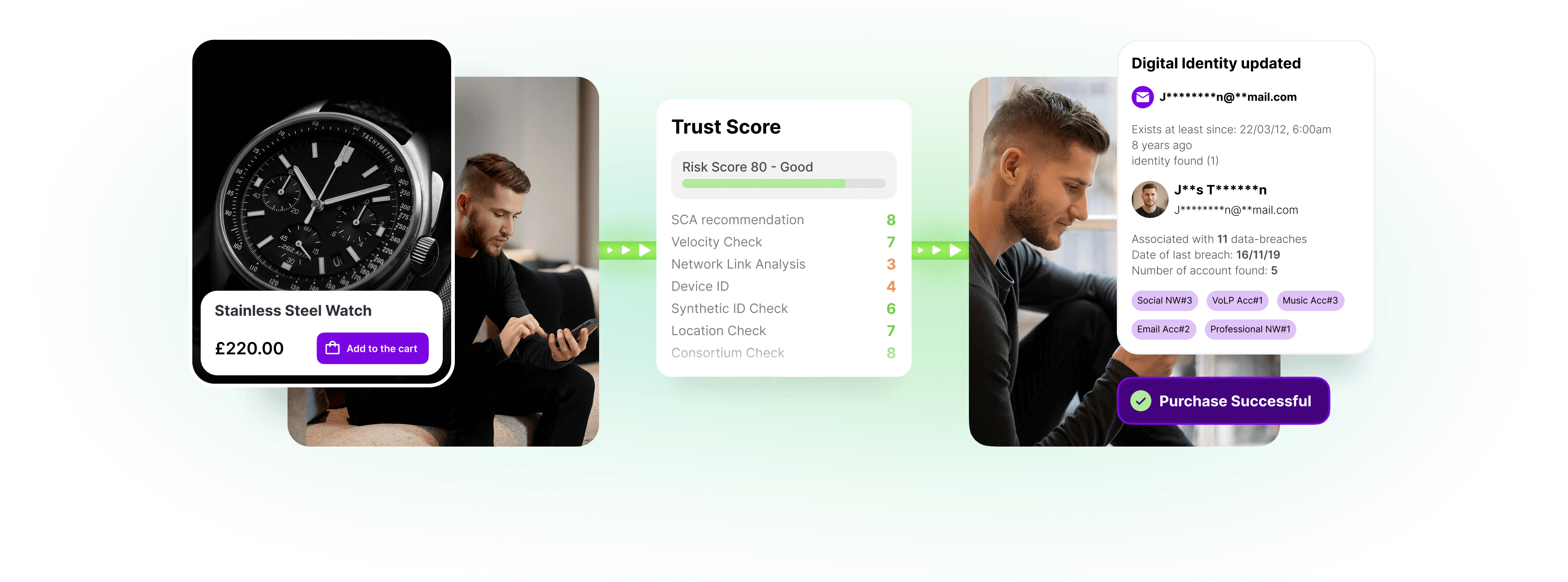

Oneytrust combines real-time scoring, millions of verified identities from our proprietary consortium, synthetic identity detection, and behavioural signals to isolate fraud without hurting conversion. Whether you handle massive order volumes or are expanding into new regions, our solution adapts to your environment.

Key strengths:

- Instant risk scoring: Risk analysis in under 2 seconds, optimized for fast, high-volume checkouts.

- Graph network analysis: Identifies fraudulent patterns and recurring profiles to prevent them from recurring.

- Digital ID validation to flag synthetic profiles before order validation.

- Enterprise-grade support: Our experts support your front-line fraud teams by providing the technology and insights needed to stay ahead of emerging threats.

What fraud managers at large e-commerce businesses need to know

Book a demo: anti-fraud protection built for high-volume retailers

Discover how high-volume e-commerce companies reduce refund abuse and fraud losses by up to 70% with Oneytrust.