The rising threat of Online Payment Fraud

Card-not-present (CNP) fraud is expensive and getting harder to detect. Even with Strong Customer Authentication (SCA), fraudsters target high-value sectors like luxury and finance.

Without advanced tools, merchants face:

- Chargebacks

- Poor customer experience

- Declining trust in online journeys

Key Challenges:

- International fraud rings bypassing SCA

- Excessive friction from manual checks or overreliance on SCA

- Limited fraud insight across channels

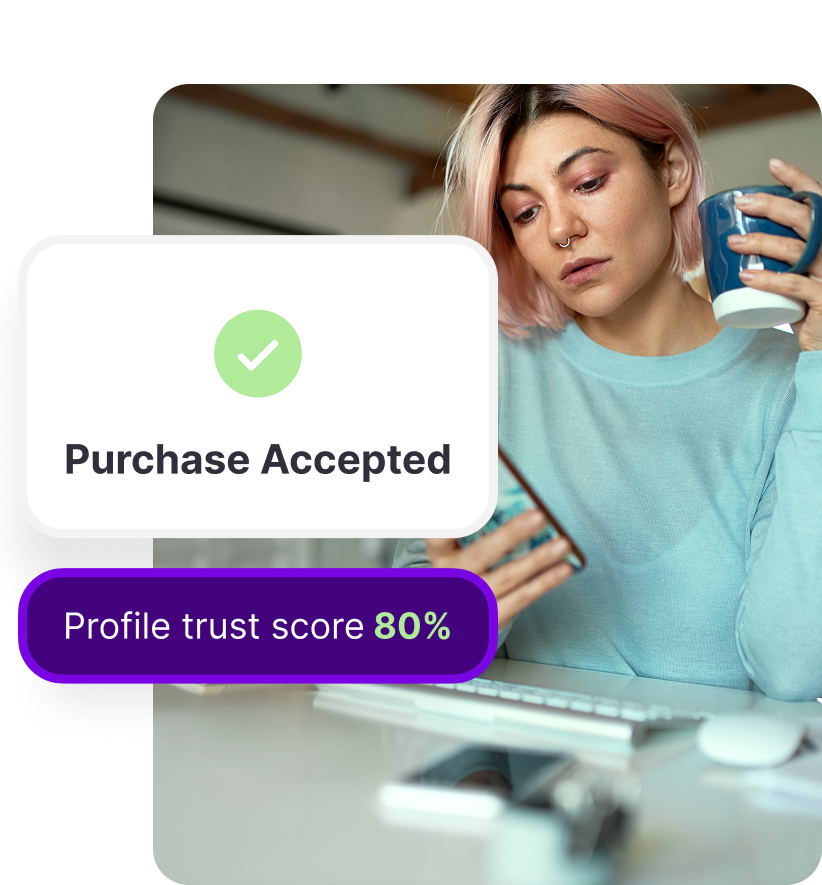

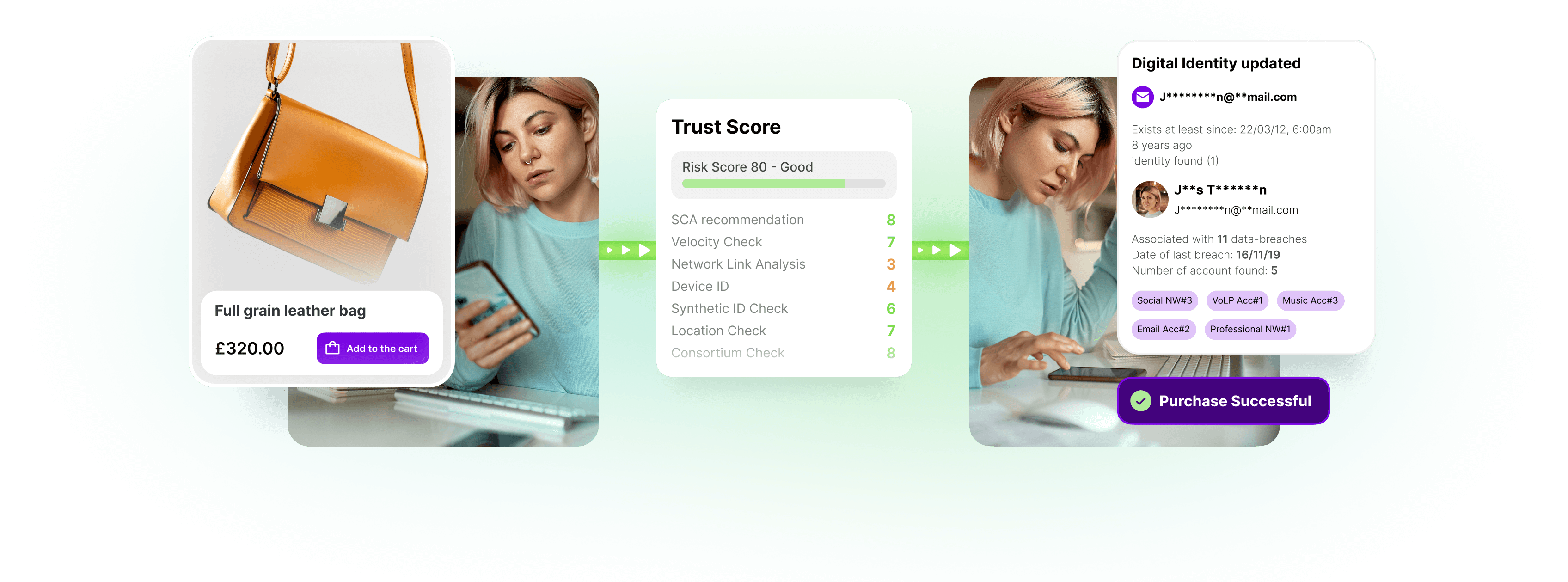

Identity-Led defense for seamless checkouts

Device Fingerprint & Geolocation

Consistency across device, user, and IP

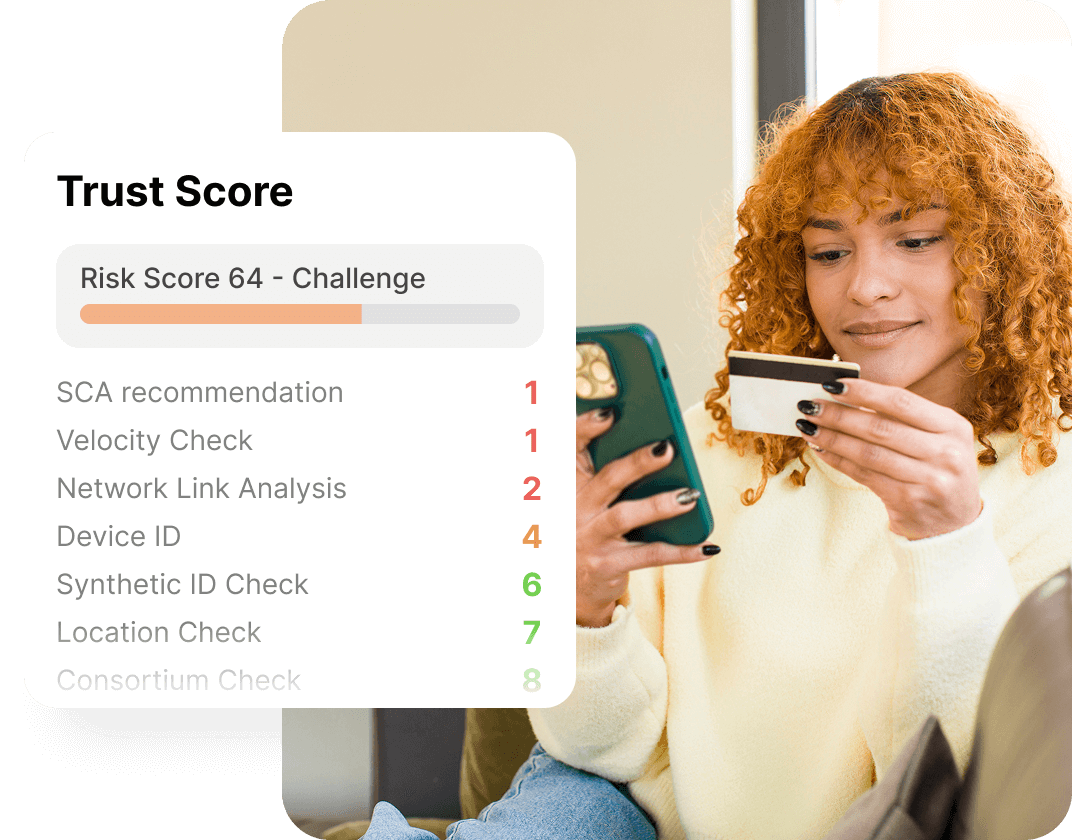

Identity Trust Scoring

Based on 15M+ verified identities in France and the EU

Behavioural Pattern Recognition

AI detects anomalies in session speed, navigation, and account reuse

Rules & Machine Learning Engine

Sector-specific logic continuously adapted to emerging threats

What Makes Our Payment Protection Stand Out

Device & IP Analysis

Detects VPNs, proxies, and risky zones

Identity Validation

Confirms consistency of user details

Velocity & Pattern Detection

Flags automated or repeated attacks

Graph Network Analysis

Detects fraud rings across merchants

Real-Time API Integration

Under 2 seconds risk scoring embedded at checkout

Proven results from the field

“Oneytrust helped us fight fraud networks while growing internationally. Their pre-scoring enabled both security and smoother checkouts.”

Typical Outcomes:

45% fewer chargebacks in under 3 months

Fraud rate under 0.08% (France) and 0.82% (outside EEA)

Real-time scoring under 2 seconds

Key questions from fraud experts

See How Oneytrust Can Protect Your Business Without Zero Added Friction

Use identity-led fraud detection to reduce chargebacks while keeping payments seamless.