What Our Clients Say…

“Thanks to Oneytrust, we’ve successfully identified and blocked organized fraud networks. Their expertise and innovative solutions have transformed how we manage return and refund fraud. Today, we operate with greater peace of mind and confidence.”

Returns Fraud is the new payment fraud

Return fraud often goes undetected until it becomes a recurring pattern. From fake documentation to synthetic identities and repeat abuse of return policies, fraudsters adapt quickly—and merchants pay the price.

Common Challenges:

- Organized Networks: Gangs targeting high-value goods

- False Claims: Forged receipts or altered invoices to trigger refunds

- Repeat Abuse: Wardrobing and chronic exploitation of return policies

How We Help You Detect and Prevent Refund Abuse:

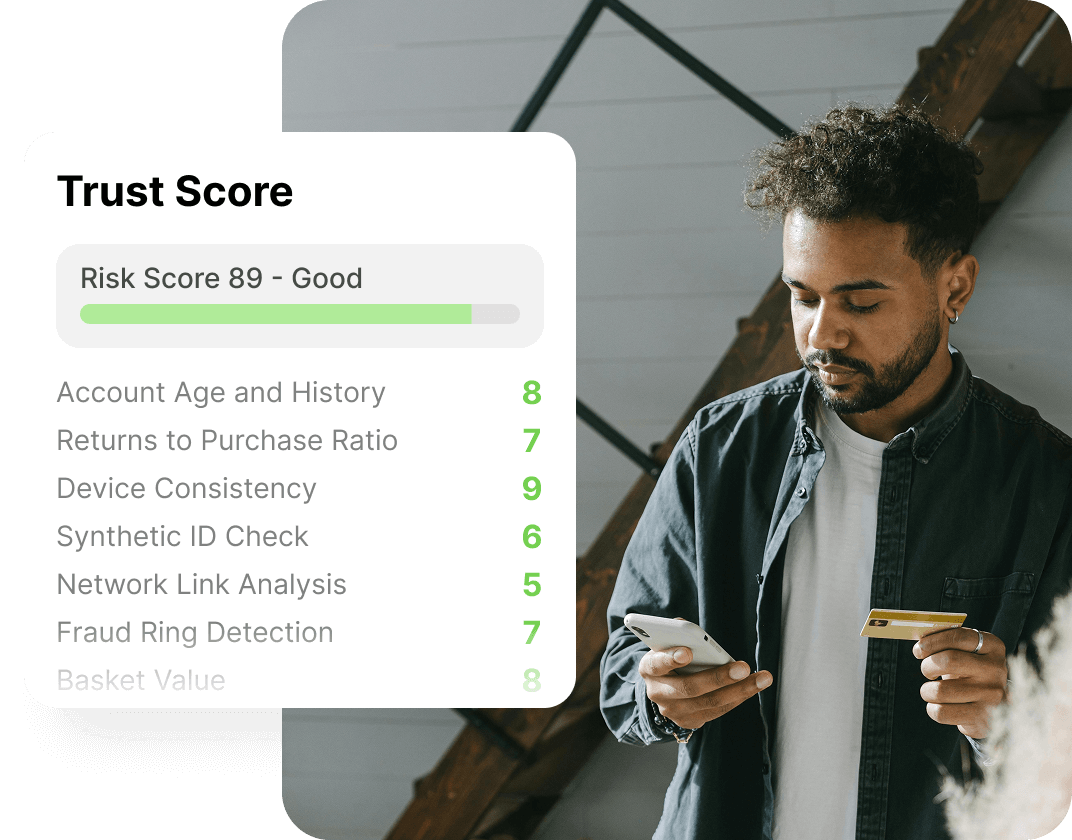

Behavioral History & Identity Scoring

We assess every return request using behavioral signals—return frequency, customer lifecycle, account history—while detecting abuse via multi-identity or multi-device activity.

Document & Claim Validation

Return fraud increasingly involves fake receipts, modified invoices, or forged IDs. We analyze document metadata and content for inconsistencies, reducing manual workload.

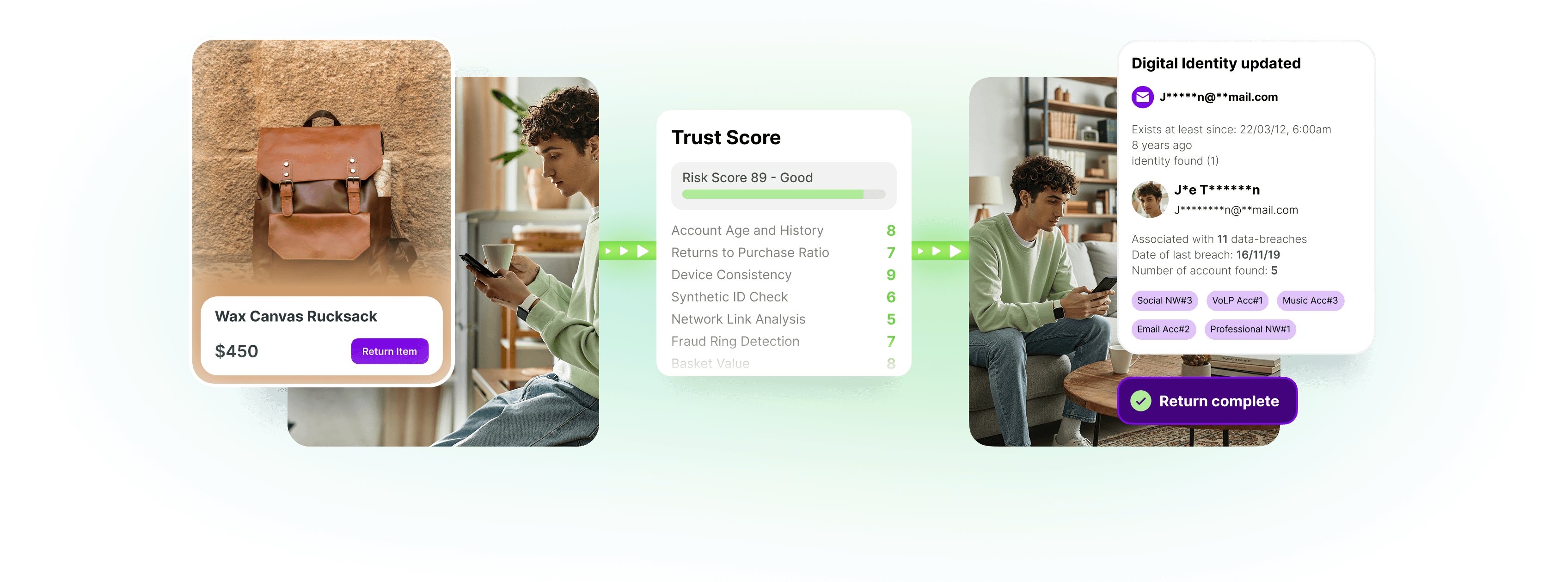

Device & Network Correlation

By cross-referencing devices, delivery addresses, and identity data across the Oneytrust network, we expose organized fraud—even when multiple accounts are used.

Adaptive Risk Controls

We help you implement automated risk thresholds on returns, flagging high-risk cases for manual review or offering store credit instead of refunds—striking a balance between fraud protection and customer experience.

Darknet Monitoring

We continuously monitor fraudulent forums and marketplaces, including the darknet, to detect emerging scams and block abuse before it spreads.

Returns Fraud: What Fraud Professionals Want to Know

See how Oneytrust identifies and prevents returns and refund fraud

Discover how to stop fraud while keeping returns and refunds workign smoothly for legitimate customers