Trusted by Europe’s leading retailers and financial institutions

“Oneytrust enabled us to identify €160,000 in return fraud within three months in 2024—without slowing down our sales. Their synthetic identity detection allowed us to safely expand BNPL to more product ranges.”

Rachid Rhilan

Head of Fraud & Payments, Galeries Lafayette

Why identity verification is no longer optional

Frictionless buying drives growth, but every removed step can invite fraud or false declines. Today’s attackers don’t just steal identities—they manufacture them and exploit payment flows, shipping options, promotions, and returns. The result: lost revenue, chargebacks, policy abuse, and poor CX.

Key identity threats:

- Synthetic identities that pass basic KYC

- Payment fraud & issuer-soft-decline traps

- Account takeover and multi-account rings

- Promo/refund/returns abuse; delivery risk

- High-friction checks that drive away real customers

Real-time risk & payments optimization—from registration through to returns

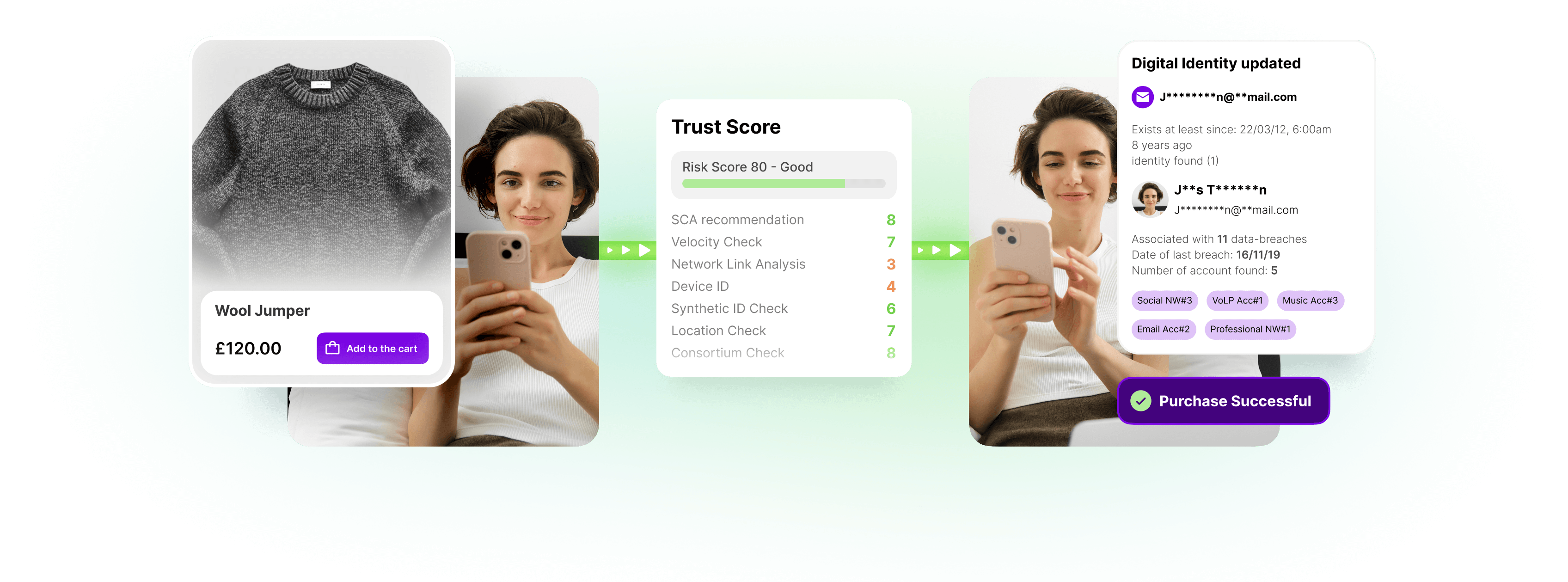

D-Risk Commerce combines identity intelligence with transaction-level payments orchestration to approve more good orders and block bad actors.

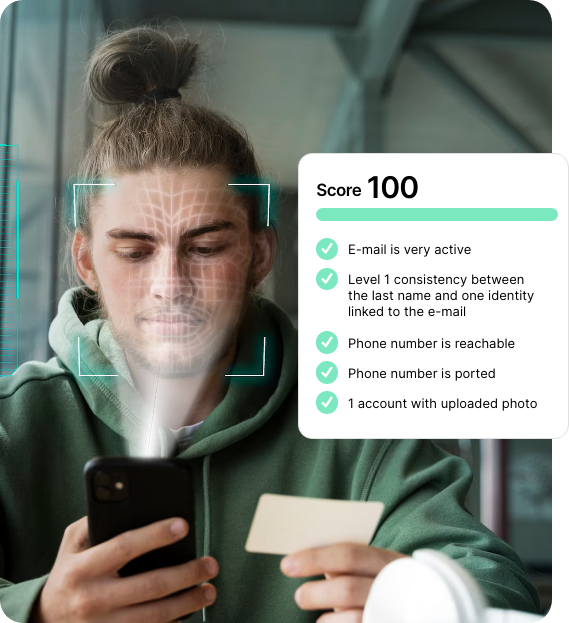

- Identity signal analysis: Names, emails, phones, and addresses cross-checked with third-party and consortium data

- Synthetic identity detection: Flags identities with no digital footprint or mismatched data

- Device & network fingerprinting: Correlates devices, IPs, and behaviors across our trusted identity graph

- Behavioral analysis: Detects bots, industrial-scale fraud attempts, and repeated abuse

- D-Risk ID trust score: Real-time score adjusts to your risk tolerance and business model

- <2 second decisions: Fast scoring ensures seamless experiences for legitimate users

FAQs – Digital Identity Verification

See how D-Risk Commerce helps you approve more good orders. Fast.

Stop commerce fraud before it starts—without compromising customer experience.